Branding During Mergers & Acquisitions: Beating the Odds

December 2023

The Context:

Most mergers and acquisitions fail, destroying value for organizations rather than creating it. The relative value of each of the participating brands carries major implications for the deal’s outcome, yet proactive brand strategy is often not prioritized. Careful branding during mergers and acquisitions can help you beat the odds and improve your chances of success.

Key Insights:

- Clearly defined brand strategy during a merger or acquisition is vital for a smooth transition and provides the clearest path to success.

- There are many strategies and approaches to consider when exploring a merger or acquisition, each with unique advantages and disadvantages.

- Mergers and acquisitions provide an excellent opportunity to clarify, strengthen or even reinvent your brand in the eyes of customers, employees and investors.

Despite their frequency, research suggests that upwards of 60% of mergers and acquisitions end up destroying shareholder value. Significant asset and personnel losses, rapid divestiture and sometimes bankruptcy are among the possible consequences of a failed merger or acquisition. A lack of brand strategy for the new entity is often a contributing factor to such failures. Prioritizing brand strategy and knowing which approach is right for your brand(s) can make all the difference.

How can you beat the odds with your merger or acquisition?

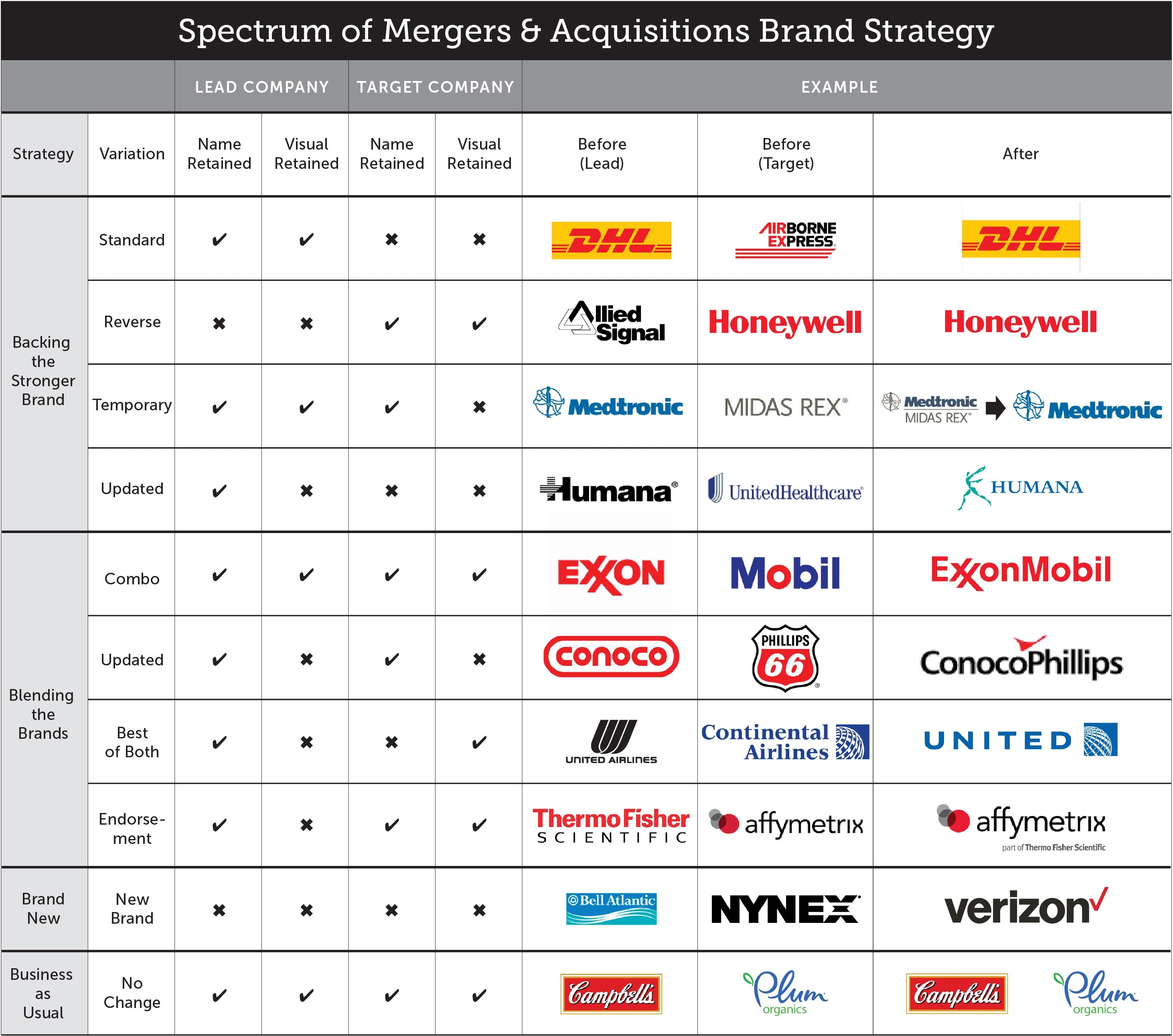

In this paper, we will discuss the importance of branding during mergers and acquisitions and explore four unique approaches to brand strategy. During a merger or acquisition, organizations have four primary strategic branding options. They may elect to Back the Stronger Brand, Blend the Brands, take a Brand-New approach or to simply conduct business as usual.

Backing the Stronger Brand

The first option, Backing the Stronger Brand, typically involves the larger, ‘stronger’ brand absorbing the smaller, ‘weaker’ brand. However, the inverse is also possible when a company with a poor reputation takes over a smaller company with a strong reputation. The merger or acquisition can be positioned as an upgrade, as both companies can capitalize on the stronger brand’s reputation. This approach can help generate excitement among employees as they see the brand’s reputation improve, and it can increase the perceived value of your product or service as well. However, be aware that this approach can also create a winner/loser mentality between the two organizations, which can cause friction during the transition and damage employee morale as a result.

Organizations may wish to temporarily combine both names and brands. This can help ease stakeholders through the transition period but can also lengthen the process overall.

When a strong company absorbs a weaker one, it also presents an opportunity to update the weaker brand. However, if expectations for the update are not met through concrete improvements to the brand experience, this strategy might have the opposite effect and leave employees and customers skeptical of the deal’s real-world value.

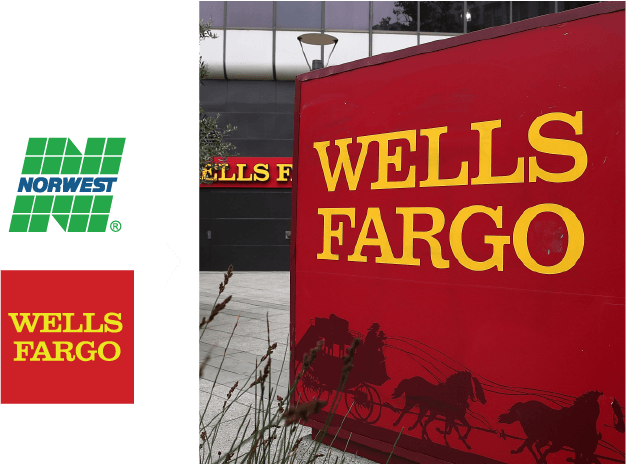

Wells Fargo

In 1998, Norwest and Well Fargo merged, electing to back the stronger of the two brands. While Norwest was the bigger entity, Wells Fargo had stronger brand equity. The iconic logo, color and name of the Wells Fargo brand were retained in the merger, both to position the deal as a “merger of equals” and to carry forward the customer trust Wells Fargo had established. This had the additional benefit of assuaging any concerns that the merger had been forced on the smaller company.

Blending the Brands

The second approach blends the two partnering organizations together into a new entity that retains key elements of each of its former brand identities. This approach aims to leverage the best aspects of both brands and suggests to internal and external stakeholders the creation of a stronger whole. While retaining the original names and branding of both organizations often provides the most seamless transition, this approach eliminates the strategic potential to build upon the strengths of each brand while addressing perceived weaknesses.

Another variation is to combine brand names but introduce a new symbol or visual identity to emphasize the integrated nature of the brands moving forward. This approach must be accompanied by clear messaging about why the merger or acquisition is beneficial to employees and customers and how the new identity will enable the organization to deliver a better experience in the future.

Blending brands can help organizations avoid the appearance that the merger or acquisition has a winner or a loser and pave the way for easier integration. However, this approach may also cause confusion about the expected behaviors and core values of the new entity as well as its leadership structure. Also, be aware that blending brands means consolidating customers’ feelings about the two former companies—positive or negative.

Taking a Brand-New Approach

The third approach is to create an entirely new brand identity for the merged companies, encompassing all of the new brand’s strengths. This presents a risk, as both companies must leave their established brand equity behind, and it requires greater planning and resources in order to execute. However, this approach enables you to more easily shed negative perceptions of either brand; clear and consistent brand strategy is vital as employees will need to understand and identify with the new brand in order to communicate its values to customers.

Truist

In December 2019, the BB&T and SunTrust banks announced a merger of equals, forming Truist Bank. This new brand reflects a commitment to renewing BB&T’s and SunTrust’s reputations for trustworthiness, transparency and honesty. The two brands used the merger as an opportunity to renew these commitments and to create a bold modern brand that would help differentiate them from their competitors.

Conducting Business as Usual

The final approach is to allow the two brands to operate independently, implementing back-end streamlining while retaining the original brands’ respective identities. In many ways, this approach is the simplest, as it has the fewest immediate branding implications. This strategy is often utilized by large organizations that have many trusted brands in their portfolios—each with long-term, loyal customers.

Diligent care must be taken to ensure that resources are not being wasted through duplication of efforts across the organization and to avoid competition between two or more brands after the transition. While simpler than the other approaches, conducting business as usual still requires careful consideration. Employees must understand why the merger or acquisition has taken place, what it means for each company and how the entities will support each other moving forward.

North American Rail Solutions

In April 2023, American Track Services partnered with Universal Rail Systems to become North American Rail Solutions, the largest rail services provider in North America. The combined entity embraced completely new, unified branding that went well beyond a new name. This brand-new merger strategy empowered two undisputed industry leaders to expand their collective size, reach and suite of services across the continent. Click here to learn more about the North American Rail Solutions merger.

Seize the Opportunity

Making a merger or acquisition work for all stakeholders is difficult, but a clear and well-defined brand strategy can help you overcome many common challenges brands face when embarking on mergers and acquisitions. Be sure to keep your messaging consistent and communicate clearly and efficiently to employees, customers and investors throughout the process. Gaining a deep understanding of both brands and their respective markets through comprehensive research and analysis will help guide your brand strategy and improve your odds of success.

Selected Sources:

- Harvard Business review: The Big Idea: The New M&A Playbook

- Branding Strategy Insider: Is Your Brand A Choice Or An Option?

- MIT Sloan Management Review: Merging the Brands and Branding the Merger

- INSEAD Knowledge: Five Considerations for Managing Brands in M&A

- The names and brandmarks of third-party companies shown in this article are the property of their respective owners

To learn more about this topic or to discuss an issue impacting your business, contact Bailey’s Vice President of Client Services, Jamie Gailewicz, at 610-818-3103 or email us at [email protected].