Is going direct to consumers an opportunity or a threat for your business?

The continued expansion of e-commerce and the relative low cost of online technology have made selling directly to consumers an increasingly viable option for both new entrants and established brands. The implications across existing manufacturers, start-up brands and retailers themselves can be enormous, altering the competitive landscape in significant ways. The decision to go direct has traditionally been framed in terms of the opportunity to bypass intermediaries (and associated costs) and the ability to control the selling process against the distribution and awareness support that retail partners provide. But it’s not a simple matter of operational costs versus wider distribution; going direct also needs to fit with the brand’s values, positioning and relationship with consumers. In this paper, we’ll discuss the considerations related to going direct to consumers (DTC) for both established brands and start-ups. For many (if not most), DTC may not be the most appropriate approach. But it’s almost certain that existing and/or new competitors have considered it. We’ll discuss the example of the razor blade industry, where newer entrants utilizing DTC approaches have shaken up the industry, and we’ll ask you to consider: how much of an opportunity or threat is DTC for your business?

It’s not just about value. It’s about values.

The direct channel can significantly strengthen the brand and its relationship with its consumers in a number of ways, including: the avoidance of intermediary costs and requirements, providing greater flexibility and potential savings that can be passed on to consumers; increased control over every aspect of the consumer experience, from pricing to presentation to product explanation; access to highly granular sales data that can be aggregated to understand consumer purchasing patterns; and the ability to respond immediately to and incorporate consumer feedback around both the product and the purchasing experience. These work if and only if the brand story is strong. And only if the brand understands that the value of DTC is about brand values and their communication to the consumer. Consumers are looking for value, but the value they are looking for isn’t only about cost; it’s about what the brand stands for.

Reframing consumer expectations

A number of start-up success stories have become case studies of building DTC into a core element of brand strategy, capitalizing on the affordability of digital marketing to launch brands directly to the consumer without intermediary stores and intermediary advertising. Eyewear company Warby Parker dramatically undercut existing price models and reframed consumer expectations around what a pair of glasses ought to cost. But—and this is important—it did it by offering a consistent and appealing brand message consistent with, and integral to, its overall strategy. Warby Parker disrupted the market and challenged the status quo, integrating the disruption into its story. Its early adopters, who drove the popularity of the brand, were young, hip and interested in trying something new. They liked being part of the disruption. Warby Parker offered not just value but also consistent brand values. And it applied its message through a social justice component, donating one pair of glasses for every pair sold. Consumers were not only buying glasses, they were supporting change—change in the glasses market and change in the world (a combination particularly appealing to the Millennial audience). The direct-to-consumer model was itself part of the Warby Parker branding message, which not only brought customers in, but also continues to bring them back.

It’s not only about what DTC has to offer the brand, but what the brand has to offer the consumer.

For products making the transition to DTC and for new products entering the market directly, the lack of distribution and associated brand recognition is a tremendous—and sometimes insurmountable—challenge. Retail outlets offer brands large-scale exposure and access to consumers in order to establish and build a relationship over time. The DTC space doesn’t have this kind of automatic exposure; awareness and consumer traffic must be built. What it does offer, however, is unprecedented access to the consumer herself and the unprecedented opportunity to control the brand story, the product showcase and the purchase experience. But only if the consumer is reached.

DTC is not exclusively about the online presence; new brands can choose to sell to a few key physical outlets to establish their presence and build credibility. They can also give consumers access to their products through community events and personal interactions. Sometimes the online DTC approach leads to brick-and-mortar stores, as in the case of Warby Parker, which has evolved beyond the original, pure e-commerce approach to integrating in-person interaction into the brand experience. Established companies that transition to DTC e-commerce don’t have to abandon their retail partners; as more and more consumers do their research online, an e-commerce option can be one purchase option among many. For established brands, in many cases DTC should not be the only option. As long as brands offer consistent messaging across sales platforms, they can successfully navigate a mix of direct sales and retail partnerships. But it’s tricky: brands run the risk of cannibalization and channel conflict as their direct lines may undercut their sales among retail partners. This challenge is particularly acute when established brands have to confront DTC competitors who use the direct channel to offer not only cheaper prices, but also new ways of interacting with and accessing the product.

Start-ups taking a DTC approach have the opportunity to integrate the DTC ethos into their branding. A number of brands have focused too much on the value offered by DTC, and not enough on the values of the brand itself. Affordability is one aspect of a company, but an overemphasis on price may come at the expense of other values that consumers may find equally if not more important.

But start-ups know: First, you have to be found

While taking a DTC approach can involve brand-owned physical locations, in many cases the direct channel will be heavily or even exclusively based on e-commerce. If the consumer relationship is to live and thrive online without the tangible experience that physical stores can provide, brands must take care to build a rich and interactive online experience. Consumers who are used to touching and feeling products in a traditional retail setting have to be given a digital experience that emphasizes the brand story and brand values. In this way, brands that may have had little customer identification and recognition, who survived by offering a unique product or a low price point in the retail setting, can particularly capitalize on the opportunities of DTC.

Without a physical retail presence, online DTC start-ups absolutely must find other ways to reach their consumers, typically through a combination of digital marketing and media coverage. Accessing the consumer is the greatest challenge to going direct: it’s hard to package or even predict what will attract the necessary attention for new brands to receive exposure outside traditional retail spaces. Physical retail partners offer brands two key elements that DTC lacks: exposure to a wide range of consumers and the in-person experience of the brand. In the retail space, products are displayed over a period of time, providing the opportunity for repeated interactions and experiences of the products, which is particularly important for attracting consumers who were not specifically searching for the brand or product in question. Physical retail outlets remain the most significant point of discovery for consumers, allowing them to see, touch and experience products directly. Through the simple expedient of being on the shelf, brands enter the consumer consciousness. Coupled with effective branding and marketing, they can become established. In the DTC space, entering consciousness is the first and greatest challenge.

Shaving away tradition: An industry focus

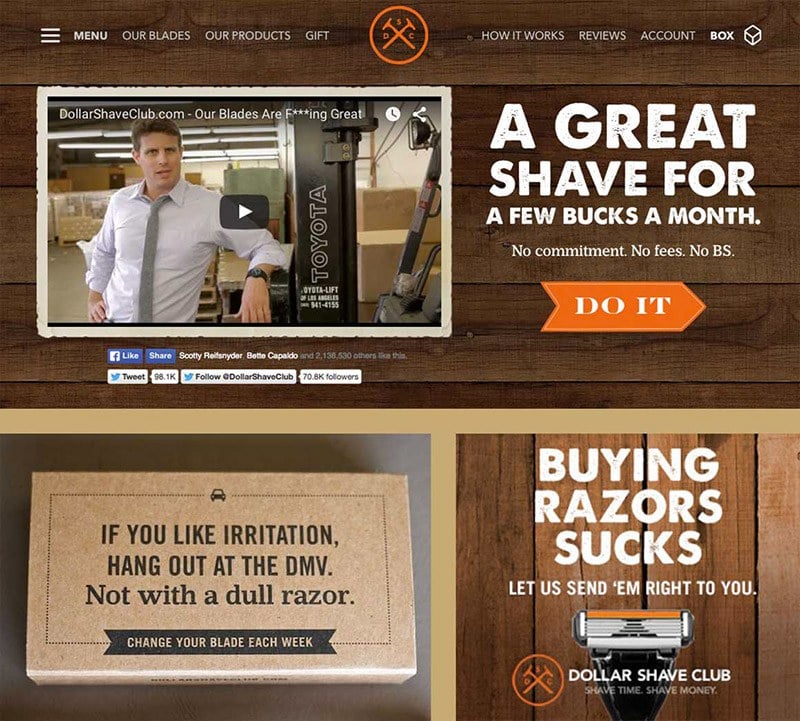

The start-up Dollar Shave Club (DSC) entered the market with a bang, going viral with its very first video, which cost only $4,500 to produce. Everything about this initial introduction to the company reinforced its fundamental ethos and messaging: DSC is an upstart and brash challenger to the established and establishment razor monopoly, Gillette. DSC built on its position as a newcomer and disrupter, promising a cheaper product and a better purchasing experience through regular deliveries in its subscription service. DSC’s first ad was brazen, fun, whimsical and explicitly targeted college-age and slightly older consumers. Its promise of a cheaper product made in a factory in Asia, cutting out the middleman and avoiding marketing costs such as celebrity endorsements that end up in the purchase price of the biggest brands, dovetailed with its overall brand strategy and character. In the case of DSC, values and value were combined in an effective branding message that was an immediate hit. The cheeky challenger succeeded in entering the marketplace and changing the expectations and is expanding its offerings to include hair care and wipes.

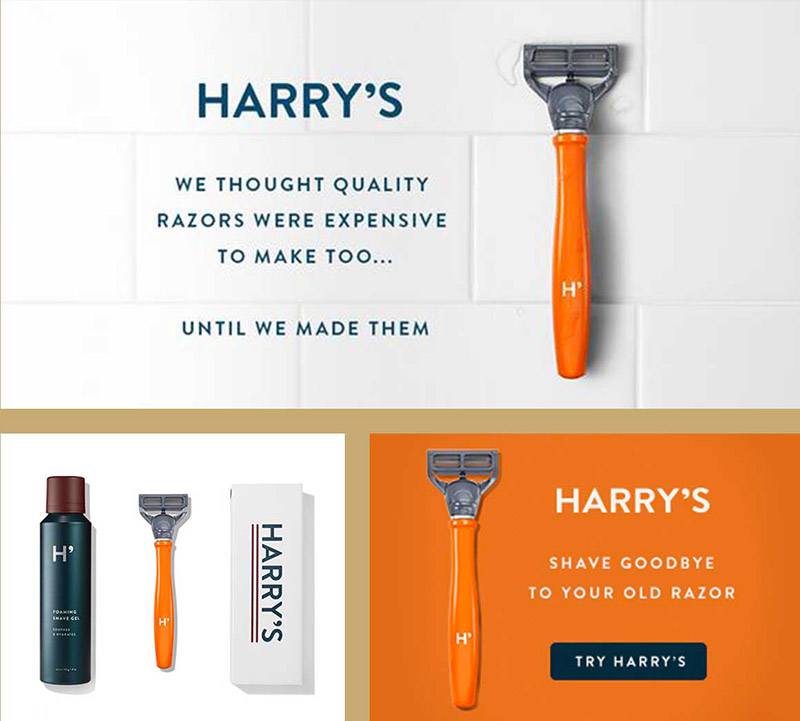

It wasn’t the only one. Harry’s is another DTC company that offers razor blades online. And it too is a challenger and disrupter, changing the way the razor blade market works, but through a different brand approach. Building on European cachet, the blades are German-made, courtesy of the factory that Harry’s purchased in its move toward total vertical integration. Slightly more expensive than DSC, Harry’s is after a more premium market, through sleeker, more sophisticated products, as reflected in its brand story. And while the two brands are competitors, these consumer-driven competitors reinforce awareness of alternatives to traditional brands.

The frustrations of consumers with the purchase experience in the razor industry created particularly fertile ground for new competitors to imagine a new approach. The viability of DTC and establishing that approach as integral to the brand story they tell helped these start-ups address this potential.

In recent years, new entrants, most noticeably Dollar Shave Club (DSC) and Harry’s, emerged to challenge the industry status quo, using DTC to disrupt the industry and create new channels for purchase. We’ll see how they made DTC an important part of their brand stories, posing a number of dilemmas for the established brand in how to respond.

How do established brands go direct? (And should they?)

With the advent of Harry’s and Dollar Shave Club, what is Gillette to do? How can it—and indeed any brand—respond to DTC competitors while remaining sensitive to channel conflict and avoiding cannibalizing its existing products and retail partners? More specifically: can established brands move to the DTC space? And should they do so?

There are huge advantages to DTC, but there are also major challenges, both for start-ups and established brands. Gillette has responded with its own shave club, but it remains more expensive than both Harry’s and DSC, and even than its own store products. Its strategy is to establish a presence in the subscription world without compromising its retail business, but it may be playing it too safe. Going direct offers the brand the opportunity to lower costs and control the brand experience at every point while building on its exposure and recognition. It runs the risk of alienating retail partners, so it must transition gradually and carefully and may choose to offer brand exclusives in one of the spaces to maintain its relationships.

But it isn’t easy. Gillette is still struggling with the balance, as are many other brands. Established companies have the advantage over start-ups when it comes to brand recognition, but they also risk alienating retail partners and working against themselves through channel conflict. As they transition to e-commerce and offer more DTC options, they need to take significant care with the online consumer experience. They must be careful to integrate purchase options directly into their brand pages rather than directing consumers to e-commerce platforms that were constructed specifically to support transactions without considering the brand experience. Today’s environment offers brands multiple ways of reaching the consumer, including selling directly online, establishing their own physical stores and building and maintaining partnerships with other retailers. As established brands seek to compete with new DTC products, they may lower their own price points and run the risk of losing consumers in their traditional retail spaces. And if they aren’t careful, brands may compromise their values and ethos in an attempt to compete in the direct space, either by changing their price points or by framing their products only in response to their competitors.

But it isn’t all bad news. There are advantages to thoughtfully combining direct points of online and retail access with sales partnerships. Luxury brands Coach and Burberry increase their traffic and brand presence by selling directly through their own stores and websites and through retail partners who have significantly greater reach and market exposure. Their partners may sometimes undercut their prices, but their own spaces maximize customer experience through total control of packaging, merchandising, display, marketing and staff interactions.

There’s no single solution to the challenges of going direct. It’s complicated, and it poses a lot of issues for both start-ups and established brands. There are also significant opportunities for brands to build and strengthen relationships directly with their consumers through their commitment to brand ethos across all platforms. But brands must pay attention to the nature of each retail platform, maximizing the advantages of each to communicate their brand messages and to emphasize not just value, but brand values.

Relationships matter

Performance apparel company Isaora had a strong retail presence in a select few high-end stores. Despite growing success, the company withdrew from retail entirely in order to control all aspects of the brand and its sales. Its transition removed many external deadlines, schedules and product demands, as well as offered it control over shipping and other timelines. It expressed concern that its retail partners did not accurately represent the brand in the ways it was displayed and in the ways that it was explained by the retail staff. It preferred to communicate details of the products and the overall brand entirely through its own channels, ensuring local and international consistency as it targeted its particular consumers rather than buyers who sold to the retail partners. While there have been savings in this transition, the company emphasizes product values, seeing the true value that they offer in the high-end performance of its brand. For Isaora, the key value in DTC is the relationship with the customer.

Selected sources:

- Greg Randall, “Why brands need to move to a direct to consumer model,” February 13, 2014

https://econsultancy.com/blog/64317-why-brands-need-to-move-to-a-direct-to-consumer-model. - Linda Bustos, “5 Mistakes Brands Make Selling Direct-to-Consumer,” January 21, 2014

http://www.getelastic.com/5-mistakes-brands-make-selling-direct-to-consumer. - Thomas Welch, “3 Direct To Consumer Brands Offering More Value than a Value Proposition,” May 22, 2015

http://www.selectism.com/2015/05/22/direct-consumer-story/.