Times they are a changing: Cultural relevancy and its implications for brand strategy

“Am I relevant?” Brands have been asking themselves that question for decades and answering “yes” with varying degrees of success and honesty for just as long. In this paper, we will examine the nature of cultural relevancy and whether a brand can legitimately lay claim to a relevant trend, and outline some of the strategies brands can employ in order to do so. But first, a quick stat: in the interim since Charles Dow calculated his first average of industrial stocks on May 26, 1896, only one of the 12 principal organizations remains intact—General Electric. Beware, the road to brand immortality is paved with those who failed to recognize coming cultural change or adapt in time to meet it. By being perceptive and nimble, brands stand the best chance of getting in ahead of the cultural curve. Remember, change is certain, but progress is not.

Let’s begin by defining cultural relevance and discussing a few examples of the trends that are shaping it. Cultural relevancy is observed through gradual changes that affect mainstream interests and consumer preferences, and ultimately instigate paradigm shifts in behavior. The trends that drive significant change become ubiquitous, influencing how a company and its products and services are viewed. Some of the main drivers impacting this perception today include health, sustainability and technology. Keep in mind, a trend should not be confused with a fad and is distinct foremost in its staying power; the former filters its way into the mainstream and establishes a degree of permanence (thus becoming “the new normal”), while the latter dissipates as consumer interest wanes.

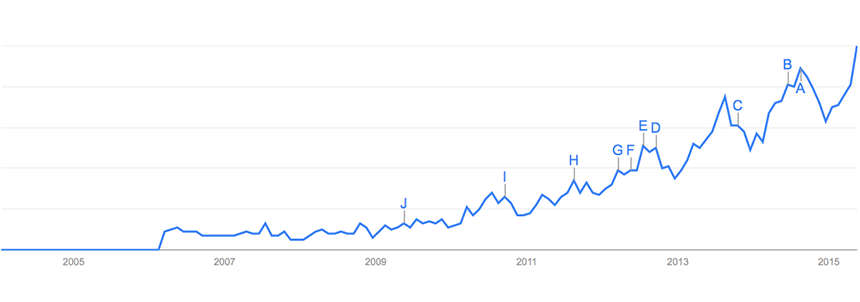

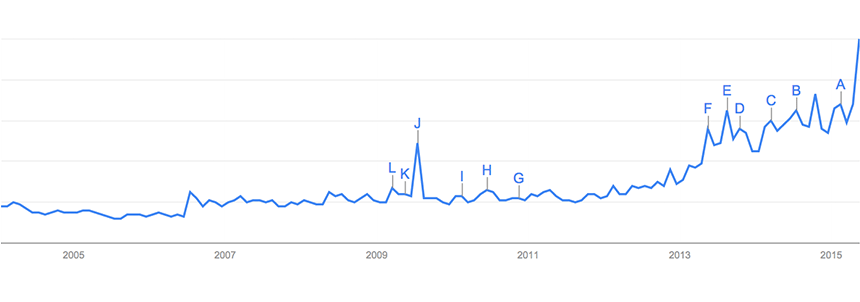

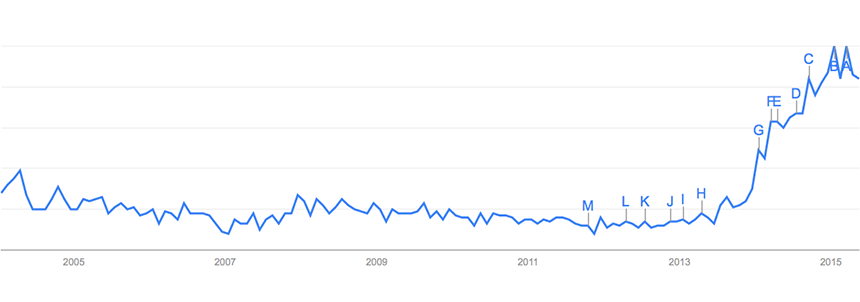

One great visualization tool you can use to observe this ebb and flow is Google Trends. Enter a term into the search bar at google.com/trends, and the system automatically charts its popularity over time by the frequency of Google searches received. Simple, if unscientific, Google Trends is a great starting point for tracking shifts in consumer interest and shaping the way you should be positioning yourself in the marketplace.

This brings us to perhaps the most important question brands need to be asking themselves: when do I act on a trend, and what factors do I need to consider in order to make the most informed decision possible? For brands with long, storied histories and established brand values, following a trend indiscriminately can come off as inauthentic. Brands both big and small need to determine whether they can authentically adapt to embrace a current trend, or whether it makes more sense to begin anew.

Brand values are fundamental to who you are as an organization and are intrinsically tied to the product or service you provide.

That is a strategic decision that should be made based on your core brand values. Brand values are fundamental to who you are as an organization and are intrinsically tied to the product or service you provide. They are inseparable from your identity in the hearts and minds of consumers. Whether or not it is appropriate for your business to react to a given trend is contingent on this key distinction: are you telling an authentic story based on an enterprise-wide idea or are you reacting to an opportunity you’d like to capitalize on? To begin to answer that question, let’s examine a few recent trends.

Health consciousness

Consumers have shown an increasing willingness to spend more for healthy, sustainable food, but the measurable value of those terms has become somewhat nebulous as more and more brands co-opt them. Farm-to-table establishments are conceived based on the principles of freshness and sustainability, and so have the most genuine claim to them. Other eateries have rushed to embrace the trend, but with dubious authenticity.

Interest over time in the search term “farm to table”

Take McDonald’s, for example. Once the titan of the fast food industry, the brand has struggled to adapt to consumers’ shifting preference for fresh, quality ingredients. The proliferation of competitor Five Guys speaks volumes about the direction the market is heading. A cheeseburger at Five Guys costs somewhere in the neighborhood of seven dollars, while the comparable Big Mac costs less than five. Five Guys burgers are also made fresh, resulting in significantly longer wait times than McDonald’s patrons experience. Nevertheless, sales for “fast casual” restaurants like Five Guys were expected to rise 9% in 2015, compared to just 2.3% for the fast food industry overall. Most people would use words like “fast” and “cheap” to describe McDonald’s offering, while words like “fresh” and “quality” come up more when discussing its competitor. These observable qualities directly reflect the company’s core values of convenience and affordability, and put McDonald’s in a difficult position when it comes to courting a more health-conscious audience.

To adapt to this change, McDonald’s has introduced new menu items, but still hasn’t succeeded in convincing consumers that it means business when it comes to fresher fast food. Five Guys is perceived as a healthier alternative because of the experience consumers have dining there: burgers and fries are cooked fresh, and most would agree taste better than a reheated Big Mac. In fact, McDonald’s burgers were recently ranked dead last in a Consumer Reports survey for taste. The company lacks the credibility to compete in that arena, and discriminating consumers approach its claims of freshness and healthiness with extreme skepticism.

Do you have the credibility to back up the claims you’re making or the heritage to participate in a given trend with a degree of authenticity?

Eco-friendly

Consumers are growing increasingly cautious about the repercussions their purchasing decisions have not just on themselves, but on society and the world around them. One of the most pronounced trends shaping the cultural landscape today is the green movement, which has facilitated an increase in environmentally conscious purchasing. Consider the emerging electric car market; in addition to cutting costs on gas, consumers are keen to embrace new technology and reduce their ecological footprint—if the price is right. The popularity of hybrid cars has paved the way for 100% electric alternatives, and more than one company will be vying for consumers’ attention in the years ahead. But do they have the credibility to do so?

The Tesla, along with outspoken CEO Elon Musk, was propelled into the public eye by bold promises to finally see the fledgling electric car industry out of its infancy. With multiple setbacks and production delays affecting the company, its rise in popularity has less to do with tangible results than it does public perception. Consumers perceive Tesla as a trusted leader in the electric car space because the company was founded on that principle—and with plans to release the $35,000 Model III by 2017, it is positioned to make good on that reputation among a wider range of consumers than ever.

Compare that to the Chevy Volt, General Motors’ attractively priced Tesla alternative. For the sake of argument, let’s say the Volt and the Model III shared an identical price tag and performed similarly. Which would you buy? Most would probably opt for the latter, if for no other reason than the Tesla has a greater claim to the eco values it purports to represent, and thus more credibility.

Interest over time in the search term “Tesla”

The takeaway from this example is that brand perception is everything. Put yourself in your consumers’ shoes and try to imagine how they might view the product or service you provide. Do you have the credibility to back up the claims you’re making or the heritage to participate in a given trend with a degree of authenticity? It’s worth noting that even a strong brand name can be detrimental to a product.

Consider Clorox. The name conjures products that run the gamut from spray cleaners to bleach. When you think about the attributes of the brand, eco-friendly probably wouldn’t land at the top of your list. It’s a perception Clorox has had to contend with as demand for greener cleaners has climbed. Since Clorox is a heavy-duty, no-nonsense cleaner, it lacks an authentic claim in the eyes of consumers when it comes to being eco-friendly—whether or not that’s actually true is beside the point.

Who owns what brands?

Specialty brands are often scooped up by larger conglomerates who may otherwise lack the authenticity to lay claim to a given trend. See if you can match these popular brands with their parent company:

___A. Mars, Inc. ___B. Kraft Foods ___C. The Coca-Cola Company

___D. Frito-Lay (owned by PepsiCo) ___E. The Kellogg Company ___F. PepsiCo

Answers at the end of white paper

That’s where Green Works comes in. A quick glance at the array of products now sold under the Green Works banner reveals far less prominent positioning of the Clorox logo in favor of the flower-centric Green Works branding and the conspicuous use of the word “natural” in all product names. Rather than attempt artificial elasticity, Clorox developed a new product line to address consumer demand—thus overcoming its biggest hurdle in penetrating an untapped market: its own brand values.

So if Clorox is synonymous with terms like “heavy-duty” and “no-nonsense,” how would we describe a brand like Burt’s Bees? The company proclaims itself an “Earth friendly, natural personal care company,” despite being acquired by Clorox in 2007. This forward-thinking acquisition signaled a new direction for Clorox, along with an admirable understanding of the limitations of its flagship brand. As with Brita, which Clorox purchased in 2000, the company reached an untapped market via a credible voice rather than fight an uphill battle with consumers over perception of its core brand identity.

It’s extremely difficult for a business the size of Clorox to dramatically alter course—larger organizations are often the most vulnerable when it comes to addressing changes in the marketplace. While smaller organizations may be more nimble, they must also think strategically and carefully consider the implications of a shift in messaging. The relationship consumers form with your brand is like any other in their lives: existing perceptions are critical and extremely difficult to overcome.

The quantified self

The final trend we will discuss relates to technology—specifically the proliferation of wearable devices. The takeaway from this shift toward technology as a total lifestyle assistant is that maintaining physical and mental well-being is more important to consumers than ever. Brands need to look further into the future in terms of their audience’s needs. How will your product affect them today, tomorrow, next week or next year? The pressures of modern life present a variety of stressors, and any product that helps soothe that anxiety, provides structure and direction, facilitates communication or delivers convenience has added value in the marketplace.

Fitbit has proven successful for exactly that reason. Beneath a simple exterior, the devices offer a suite of relevant and meaningful features consumers use and value in their day-to-day lives, like step tracking, sleep monitoring and calculating the number of calories burned. This information provides direction that can help modify behavior, including eating habits and activity choices. Like Tesla, Fitbit creates products intrinsically tied to its corporate identity and thus is viewed by consumers as an authentic voice in its field. The proof is written on the wrists of outgoing, active consumers everywhere.

Interest over time in the search term “wearables”

Google Glass has conversely divided consumers—in part because the utility of the device and the scope of the company as a whole are so broad. Though the glasses have achieved a certain “wow” factor technologically, Google has yet to effectively communicate how they will improve consumers’ lives. The high price tag and perceived nuisance of the necessary eyewear have further alienated would-be buyers. What we can glean from this example is that a brand with clear ideals and a focused message stands the best chance of connecting with its audience. Even if your product is futuristic, it isn’t future proof—you still need to employ sound brand strategy and exhibit the requisite adaptability to outpace and outlast the competition.

Reinventing your audience

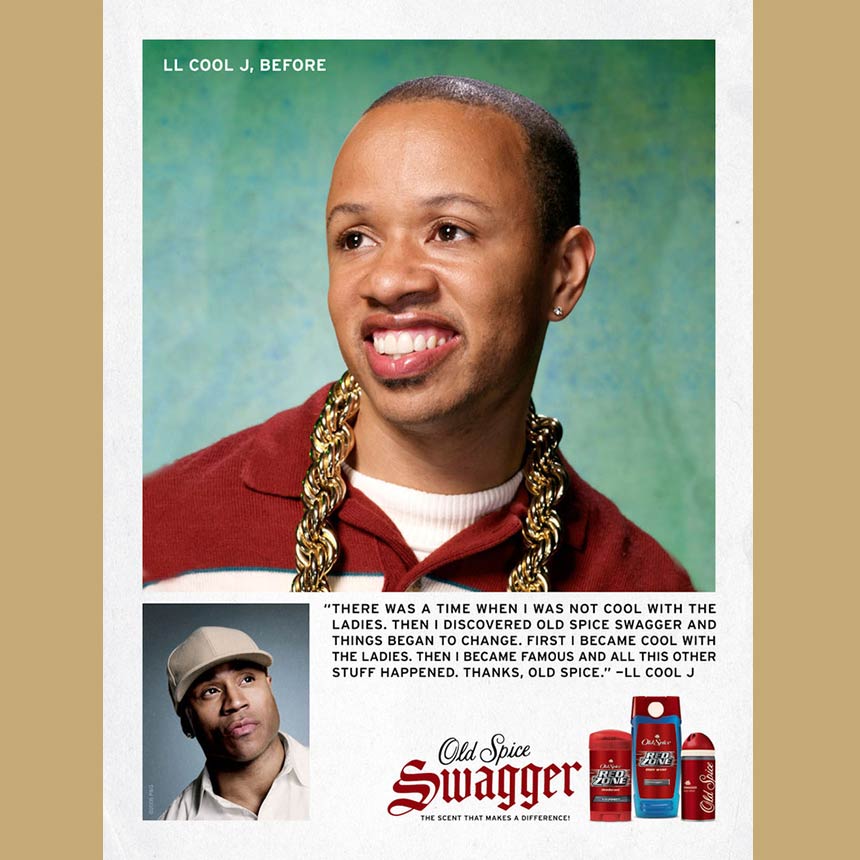

Founded in 1937, Old Spice was for many years a prim and proper deodorant brand with stodgy ties to Colonial America. However, it reset its sights on younger consumers in recent years with a series of zany ads that has completely changed the way it’s perceived in the marketplace. By speaking the language of younger consumers, Old Spice was able to sidestep its irrelevant heritage and earn the attention of an entirely new and valuable demographic. Changing the conversation about your core values can be an extremely difficult proposition, but by planting the seed and letting the consumer cultivate it, Old Spice managed a rare coup in the marketplace.

Selected sources

http://trendwatching.com/trends/7trends2014/

http://www.treehugger.com/corporate-responsibility/burts-bees-is-purchased-by-clorox.html

http://google.com/trends

http://jalopnik.com/elon-musk-says-model-3-will-cost-35-000-before-incent-1679351127

http://news.oldspice.com/about/history_timeline

2015 Fast Food Stat Sales Projection: Morgan Stanley analyst John Glass

1. Stacy’s Pita Chips D. Frito-Lay

2. Naked Juice F. PepsiCo

3. Back to Nature B. Kraft Foods

4. Seeds of Change A. Mars, Inc.

5. Odwalla C. The Coca-Cola Company

6. Kashi E. The Kellogg Company